Incoterms 2020

Find out everything about the latest version of the Incoterms, namely that of 2020. Here we answer questions such as; What are Incoterms and why are they important?

Incoterms meaning

The Incoterms are an initiative of the International Chamber of Commerce, also known as ICC. The Incoterms have been drawn up to make international trade between companies easier, clearer and safer for both the buying and selling party. The Incoterms actually tell the buyer and seller what their obligations are during the buying and selling process. In addition, all agreements do not have to be manually included in the purchase contract, but 1 reference to the Incoterms is sufficient.

So when you are going to buy or sell, it is wise to include an Incoterm in the purchase contact. Which Incoterm best suits your shipment depends on several factors. Often a golden mean is chosen. Also, not all Incoterms apply to the mode of transport you choose.

Curious about what all Incoterms mean and which one is best for you? Read on below and find out what the pros and cons are of the different Incoterms!

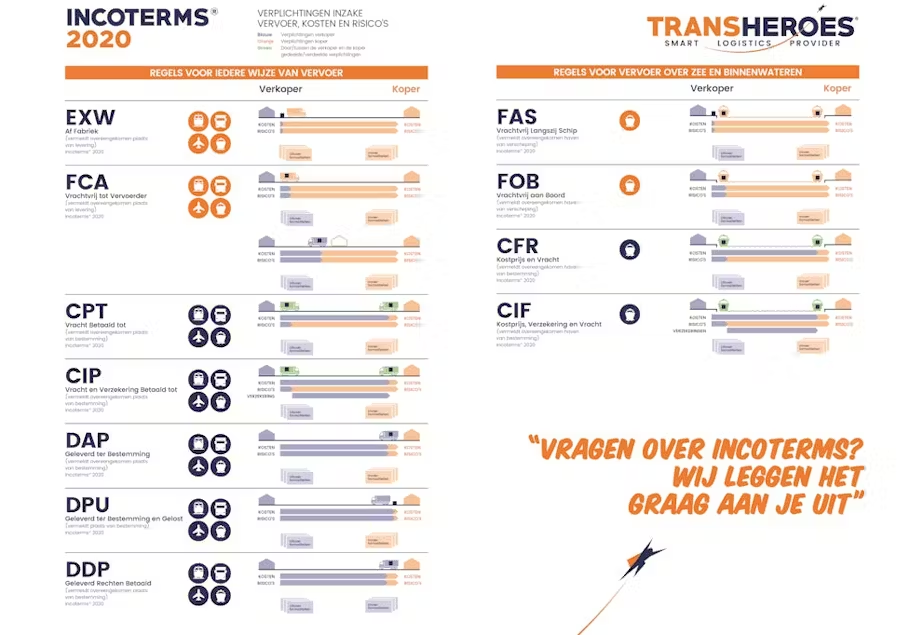

An overview of the Incoterms

A total overview of all Incoterms with the obligations regarding transport, costs and risks for both the buyer and seller. It doesn't get any clearer than this!

Which Incoterms are there and what do they regulate?

The Incoterms describe 3 important matters during the purchase and sale of goods, namely the obligations for who arranges what, where the Risk lies and for whom which costs are incurred. The Incoterms are a right of clause, which means that they only apply if both parties agree. A brief overview of which Incoterms are available:

- EXW : Ex Works

- FCA : Free Carrier

- CPT : Carriage paid to

- CIP : Carriage and Insurance Paid

- DAP : Delivered At Place

- DPU : Delivered at Place Unloaded

- DDP : Delivered Duty Paid

- FAS : Free Alongside Ship

- FOB : Free On Board

- CFR : Cost and Freight

- CIF : Cost, Insurance and Freight